Is poor credit STOPPING you from getting your home, car, personal or business loan funded...it doesn't have to?

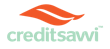

Collections

Foreclosures

Student Loans

Medical Bills

Since 2004

Raise Your Credit Scores

Our Goal is to help 1,000 People & Businesses in 2025 Get the Money they need to start or grow their business...Will you be one?

Your credit score has five main contributors

Normal Credit Repair focuses on only 2 of these factors - your payment history and new credit - which make up 45% of your overall score.

Learn more with a FREE credit consultation

6000 Customers per month use this service!

Start here 550

Finish here 700+

Bankruptcies

Excessive Inquiries

and much more...

Law firms normally charge $1500 to $2500. But you can get started for $19.00

Generally 53-187 point increase

Even one mistake could decrease your credit score by 110 points. And cause you to be denied credit & pay higher interest rates on EVERYTHING you finance.

WHAT IS A CREDIT SWEEP?

WE ONLY MAKE MONEY IF WE GET YOUR BUSINESS MONEY!

Our 3rd party vendor is motivated to get your scores up fast because they understand our Goal is to Fund your Business as fast as possible...And that's why this service is different. Our goal is to get your scores up within 30-45 days so we can get your business loan funded...period.

Compare the cost of this service to the amount of money you need to start or grow your business

Real clients with Real businesses!

Kim already had a thriving Amazon delivery business but during the process of establishing her business her credit suffered. She was able to get a much better interest rate and approved for a $225K MCA loan.

Credit Scores before:

Transunion 499

Experian 525

Equifax 580

Credit Scores after:

Transunion 615

Experian 650

Equifax 675

* Please note Kim already had a business generating significant monthly revenue so her low credit scores weren't as much of a factor in getting approved but she was able to get a much lower interest rate on her MCA which saved her over $1500 per month.

Julie started her online gift subscription company with a $125K Line of Credit.

Credit Scores before:

Transunion 580

Experian 625

Equifax 640

Credit Scores after:

Transunion 705

Experian 715

Equifax 720

Tim started his SAAS platform with a SBA loan for $75K.

Credit Scores before:

Transunion 565

Experian 630

Equifax 660

Credit Scores after:

Transunion 705

Experian 715

Equifax 730

How it works

We're changing & positively impacting our clients lives

How much will a negative item hurt my credit score?

According to CreditCards.com and CNNMoney, even a single negative on your credit could cost you over 100 points.

A DEROGATORY CREDIT SWEEP can help!

California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. All such loans made through CreditSavvi, LLC, a wholly-owned subsidiary of CreditSavvi, Inc. and a licensed finance lender/broker, California Financing Law License No. 60DBO-44694.

There’s an (OPTIONAL) small business loan waiting for you!

Whatever you need, there’s a loan option to help you. Seriously.

Copyright © 2024 CreditSavvi. All Rights Reserved. | 5 Concourse Pkwy, Atlanta, GA 30328

Are you GDPR compliant?

Yes, we are GDPR compliant. Click here for more details.

Higher Credit scores makes you happier :)

1. ANALYZE

We work with you to identify any questionable negative items hurting your score

We challenge those negative items with the bureaus and your creditors

2. ADDRESS

3. ACCELERATE

We keep the process going, helping you reach your credit goals

Startup Loan

Launch your new business without giving up any equity.

Interest Rate As low as 4.25-6%

and there's a Small Business loan waiting for you! (optional)

(Scroll to the bottom to view loans available)

Business Line of Credit

Gain access to additional cash whenever you need it.

Interest Rate As low as 8-24%

Equipment Financing

Finance business tool, from tractors to software.

Interest Rate As low as 7.5%

Business Credit Card

Increase working capital while building business credit.

Interest Rate As low as 8-24%

SBA Loan

Get a boost with SBA 7a, 504 or Express loan

Interest Rate As low as Prime+

Micro Loans

Get access to just enough cash to keep your business going.

Interest Rate As low as 8-10%

Business Term Loan

This standard loan is a goto for many business owners

Interest Rate As low as 6%

Short Term Loan

Flexible business financing with 1-3 year terms.

Interest Rate As low as 8%

by removing the following items:

Child Support

Tax Liens

Public Records

Repossessions

81% Approved for Business Loans

74% Approved for Refinancing

71% Approved for Home Loans

78% Approved for Auto Loans

1 855 931 1470