Contact us today at support@creditsavvi.com or Call us @ (888) 502-3111 Monday - Friday | 9am - 9pm Eastern Time

Copyright © 2025 CreditSavvi. All Rights Reserved. | 5 Concourse Pkwy, Atlanta, GA 30328

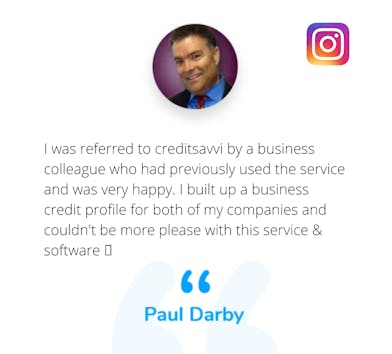

Let Us Build Your Company a Solid Business Credit Profile Using The Same Software The Big Guys Use & Get You A High PayDex Score!

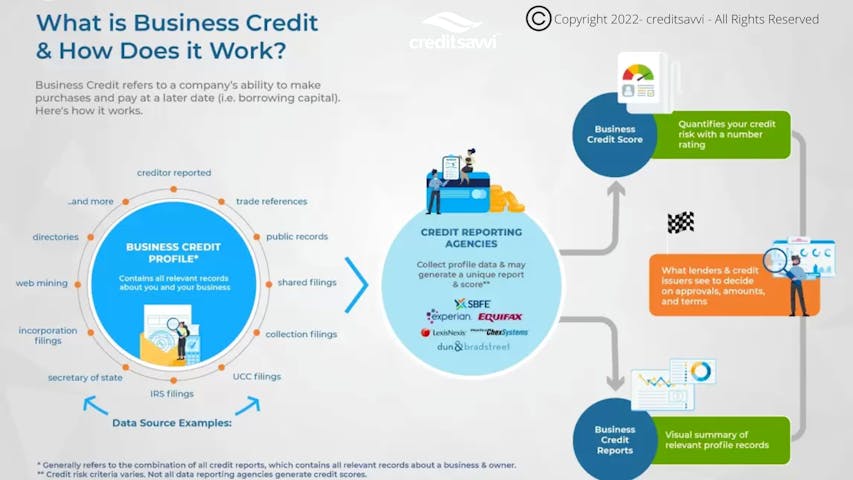

What is Business Credit?

Lower Monthly Payments

Protect your personal credit profile (separate your SSN)

Not only more but higher credit card limits & lending options available.

More favorable lending terms (lower rates & longer payback terms)

More Negotiating Power

Better Chances For Loan And Credit Card Approvals

Business credit is credit in the name of your business only (EIN#). It is based on how likely the business is to repay bills, not the owner.

#1 GOAL. Get up to $250K in Your EIN# with no personal guarantee...

We're helping clients build Award winning Business Credit Profiles!

The benefits of business credit

More leverage to negotiate with vendors

Improves the value of your business.

Attract more clients especially B2B

Lowers insurance premiums & allows more financial flexibility & strategies

What our service & software does for your business.

Lender Compliance

There are over 150 items lenders check before approving your loan. Our software focuses on the top 20 While addressing all 150 to make sure you're lender compliant and ready for funding.

Business Reporting Trade-lines

We add 15 high quality tradelines to your business profile. (7 vendor Lines, 5 business charge cards, 3 installment lines). All tradelines will report to Equifax & Experian business, creditsafe & Dun & Bradstreet.

Business Credit Scores

Let's you see your current status on 12 critical points that are key to your business success

Becoming Bankable

Becoming Bankable Is A Table With Four Legs

When your business becomes bankable that means you have separated personal credit from business credit and established a business entity that can stand on its' own for financing.

- Leg One - Lender Compliance

Lender compliance is a series of small items that a lender's underwriting computer is going to immediately check when you apply for a business loan. Lenders are simply looking to see if your business falls into known higher rates of default. Until Lender Compliance is completed, your business will be considered high risk.

- Leg Two - Business Credit History & Scores

If you look at your business credit reports and you do not see at least 10 reporting trade-lines, then you have too little business credit history to be considered bankable.

- Leg Three - Business Credit Scores

You are well aware of how important it is to have 700 or higher personal credit scores. For your business to become bankable it must have business credit scores of 70 or above which are just like having 700 scores personally.

- Leg Four - Business Bank Rating

Lenders want to see that your business has the ability to debt service or cover the monthly payment for the loan amount you are requesting. For this they are going to look at your business bank rating that will tell them if you have the money to make their payment or if it is more likely that you will default.

Only a small percentage of businesses take the time to become bankable before they apply for financing. By completing the Business Success Assessment you will see where your business stands now in becoming bankable and know what to do to become bankable in the near future.

NAP validation is the new standard requirement for having your business listed on the mobile map services such as google, apple, facebook, uber, and onstar services.

NAP stands for Name, Address, Phone Number. NAP is critical if you want your business to rank well in local search results, because search engines take NAP into account when determining which companies to show local results.

NAP Validation

(click the icons below to watch short video)

Pre-Qualified Funding

We have relationships with over 75 lenders specializing in all kinds of businesses. Once we get your PAYDEX SCORES up (Business Credit Scores) we get you pre-qualified with one or more of our lenders.

Other Benefits

*The free scan looks at 150 data points on your business and lets you know where you stand for business financing, business credit, lender compliance, and everything about your current online footprint; SEO, star ratings, local listings and more. Then, it provides a step-by-step guide how to optimize each aspect of your funding pre-qualification, building strong business credit scores, the owner's personal credit scores and your online marketing success.

5.0

4.5

4.2

4.1

5.0

Our Featured Partners